Why should I take an IR35 test?

Last Updated: 20-09-2021

Reading Time: 10 minutes

As a contractor, you may think that your contract is watertight. You may think there's no need to take an IR35 audit. Your agency told you your contract was 1000% HMRC safe. But don't bank on it! According to HMRC:

"There's no such thing as an IR35-proof contract"

No one can argue with that statement. Contractors can, however, be proactive.

You can submit your contract to an IR35 specialist for appraisal. Working together, you'll find ways to help establish that you’re not a disguised employee.Getting something like 'safe' will mean you taking action and working with a trusted third party. It will mean you taking nothing for granted. It will mean you have to take an IR35 test. It is that simple.

What's the worst that can happen?

If The Revenue contact you to say that they're opening an inquiry into the way you trade, don't panic. I mean, how much impact can an IR35 enquiry have on your business, anyway?

Sure, you'd have to forsake all those tax advantages that make limited company contracting worthwhile.

Sure, you'd have to forsake all those tax advantages that make limited company contracting worthwhile.

And, yeah: you'd have to work PAYE. As a limited entity, that means paying full NICs (employer's and employee's).

Oh, and you can forego all those expenses claimed against corporation tax, too.

But you do get to keep some things.

You can still claim relief against your pension contributions. But you might have to reduce how much you put by to cover the extra taxes you'll be paying.

What you'd keep and what you'd lose

There's a chance you'd keep your client, too. That's if the grilling by the taxman doesn't dissuade them. Or they don't get scared and blanket-ban contractors from their operations.

And, of course, you may (or may not) choose to keep your accountant. But working PAYE limits how effective they can be for you.

And, of course, you may (or may not) choose to keep your accountant. But working PAYE limits how effective they can be for you.

And, mm, no…that's about it for what you might keep.

Imagine you charge £25/hour; you won't lose so much over a year if you're caught inside IR35. Well, if you say it quick enough and shut your eyes it won't sound a lot.

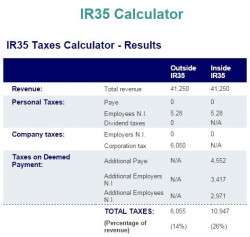

To outline what you might lose, here's an example using Contractor Weekly's IR35 calculator. If you're charging a modest £25/hour, you'd only pay £4,900 a year in overall duty. Extra!

What's a hike in tax of 14% of your revenue (outside IR35) compared to 26% (inside) between friends?

Okay, I admit it. I was fibbing. Yes: you should start to panic, now. Just a little.

What do HMRC actually investigate in an IR35 enquiry?

When the taxman decides he wants to look into your affairs a little closer, be open to them. You will have an opportunity to meet them face to face. You will get the chance to explain why you claim to be outside IR35.

Did I mention now might be a good time to take an IR35 test? Oh, I did. Just checking.

I digress. Alongside the invitation to explain yourself, the taxman's welcome letter will also ask you for a:

- detailed account of your business's annual income for a given year;

- copy of the contracts you undertook during the year in question.

If, upon examination, HMRC thinks there's a chance you were inside IR35, they'll continue with the case. It's at this point you get the chance to face them. If you don't, they'll carry on without you and keep you in the loop.

Their focus will be on the relationship you had/have with your client. If you've not taken reasonable steps to prove that you're not a disguised employee, you're in trouble.

They will interview your client(s). If you're working through an agency, they'll examine the agency's documents and interview them.

Out of interest, what else is at stake?

There's more on the line here than a few grand a year. Sure, that's gonna hit you where it hurts, in your take home pay. But consider how your client will feel when HMRC turns up to interrogate them.

They're not going to be chuffed about the time they lose. Neither will they thank you for the exposure of their business you've brought to their door.

But more than anything, you can't guarantee that what they reveal won't incriminate you further.

They may not do it on purpose, but face it: they're not contractors. They don't know what's going to make you look good or bad, unless you can prepare them for it. And, yeah; good luck with that conversation.

So you don't want that. Any of it. Even worse, if HMRC question your contractor status, they can go back years. If:

So you don't want that. Any of it. Even worse, if HMRC question your contractor status, they can go back years. If:

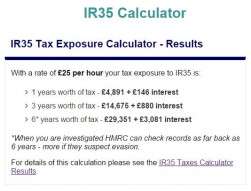

- your working arrangements haven't changed, they'll go back up to six years;

- they suspect evasion, they can go back even further.

For every year they decide that you were inside IR35, you'll owe interest on those unpaid dues.

In the £25/hour example and using the current 'APR' of 2.5%, interest alone could amass to over £3,000. And that's without taking tax evasion into account.

Perception is everything

You may ask why I'm interested in you upholding your contractor status. Simple: there'll come a time when you want to leverage your contract earnings to get credit.

If that credit is for a mortgage, you'll need maximum leverage to get the most competitive interest rates. To qualify for the best contractor mortgages, you'll also need a decent deposit.

If your business is subject to IR35 penalties, you may struggle to accrue a deposit that your earnings reflect you should. The repayments you can afford will also nosedive. This will raise questions with a lender.

Just for a minute, imagine the conversation between a broker and a potential mortgage lender:

"I've got George, here; he wants a mortgage. He's on £25/hour, and has a six-month contract. What can you do for him?"

"Let's see, shall we. At £200/day, x 5, that's £1,000 a week. By 46 is £46,000 a year. Based on a multiplier of 4.5 times salary I can offer…"

"Just a minute. I have to tell you, George has to pay both National Insurances and he's on PAYE. It's only while the investigation's ongoing, but he'll be able to afford more when he's out of IR35."

"Oh. He's been caught out by the taxman? That's going to have a huge impact on how much we can lend him."

"Yeah, I know. But it can happen to anyone. If they're not treating what they do as a business, it's a simple oversight."

"So you're saying that he's a limited company contractor, but he's not a responsible business person?"

"Well, no. I mean, yeah. But he didn't see the value in paying for an accountant, at first. Yes, it was foolish. It happens, though."

"Yes, it does. So, tell me. How's he going to keep track of what he earns now?"

"Oh, now that the client's assured George of an ongoing contract after HMRC grilled them, he's hired an accountant."

"Well, isn't that going to eat up even more of his revenue?"

"Yeah, but not as much as you think. They don't charge that much in comparison to what they can save a contractor."

"Well, that only makes the fact he didn't hire one in the first place worse. Let's see; we can offer George this bedsit in Royston Vasey…"

I'm not trying to be condescending or facetious. But this stuff matters, both for your credibility and its impact on your life outside of contracting.

Many renowned firms offer full contractor support. Contractor Weekly we've mentioned in the examples above. Qdos offers a whole suite of contract review products to help you stay outside IR35.

It takes mere minutes to calculate take home pay based on your contract rate. No excuses. Run your details through an IR35 calculator; make time to take the test. You'll be so much better off in the long run, both in your mind and in your pocket. Result!

John Yerou is a pioneer of contractor mortgages and owner and founder of Freelancer Financials, Contractor Mortgages®, C&F Mortgages and Self Employed Mortgages, trading styles and brands of the award-winning Mortgage Quest Ltd.

Posted by John Yerou

on January 30th, 2015 19:50pm in Contracting Matters Blog.